Texas Instruments, a maker of analog chips, has told customers that the supply-demand imbalance will ease in the second half of this year. That followed a nearly 80% drop in the prices of some of Texas Instruments' products. The move by TI, the king of analog chips, also means a slowdown in the price of analog chips, led by power management chips. The personage inside course of study thinks, chip is out of stock peak already passed, analog chip price may usher in unilateral downward trend, chip enterprise should prepare for early.

Analog chip "three strong" once expanded production busy

Due to the rapid growth of new energy vehicles, 5G and other demands, since the global core shortage situation broke out in the fourth quarter of 2020, analog chips have been seriously out of stock, and the price has continued to rise. Among them, power management chips, which account for the largest proportion, are seriously in short supply, becoming a popular category in the semiconductor market. IC Insights reported that the analog chip market grew 30% in size in 2021, outpacing the 26% growth of the integrated circuit market, with each general and application-specific analog product segment achieving double-digit sales growth.

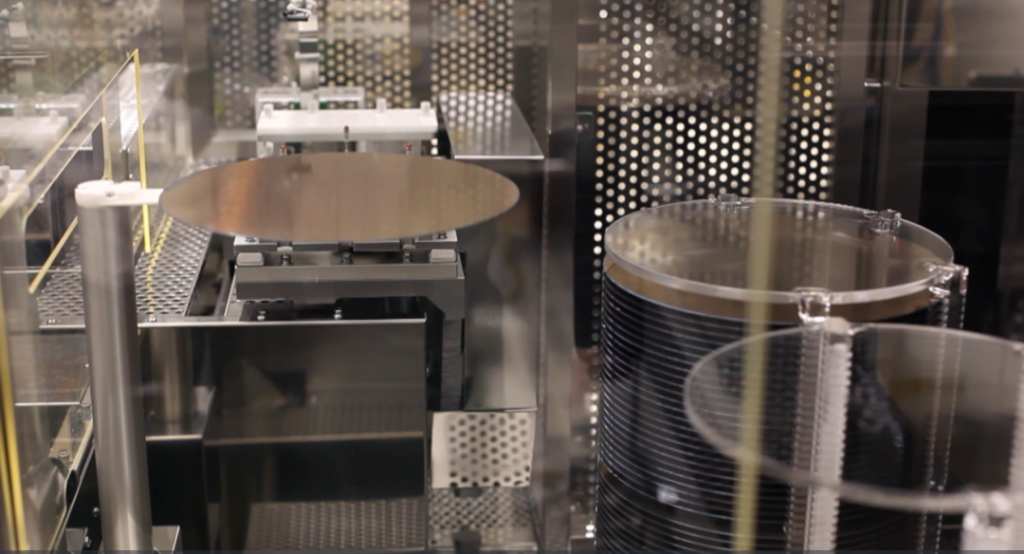

During this period, many enterprises began to expand analog IC business, the top three Texas Instruments, ADI and Skyworks began to "wild growth". Texas Instruments, a firm leader in analog chips and traditionally cautious about expanding, bought micron's 12-inch wafer manufacturing facility in Utah for $900 million in July 2021. Ti plans to adapt it to make analog and embedded chips for the 65nm and 45nm processes.

ADI, ranked second, is committed to catching up with Texas Instruments quickly through mergers and acquisitions. In 2021, ADI finally made its "trump card" and completed the acquisition of Maxim, also an analog chip giant, to further consolidate its position in the analog market. At that time, ADI's market capitalization was about $46 billion, while Maxim's market capitalization was about $17 billion. Industry estimates of the combined value of the two companies were close to $70 billion, significantly narrowing the gap with Texas Instruments.

No. 3 Skyworks saw its revenue grow 49% between 2021, the highest growth rate among the top 10 vendors. In July 2021, Skyworks acquired the infrastructure and automotive businesses of Silicon Laboratories for $2.75 billion to accelerate its expansion in electric and hybrid vehicles, industrial and motor controls, 5G wireless infrastructure, optical data communications, data centers and other applications. In its communications business, the partnership with Apple accounted for 59% of sales, making Apple Skyworks' largest customer in 2021.

It can be seen that with the ferocity of the market, enterprises began to grow rapidly and even began to narrow the gap with Texas Instruments. In 2018, Texas Instruments ranked first in the analog chip market with 18% market share, while ADI ranked second with only 8% market share. The market share of other major companies was also in single digits. By 2021, TI's share of the analog chip market was 19%, followed by ADI's 12.7% share and Skyworks's 49% growth in 2021, despite an 8% share.

"Oligopoly Effect" in Analog Chip Market

According to IC Insights' latest report, the top 10 analog chip vendors will have combined sales of $50.4 billion in 2021, accounting for 68% of the entire analog market. And over time, the ranking of the top ten manufacturers has not changed much.

Therefore, the entire analog chip market has been an oligopoly effect, led by Texas Instruments giant manufacturers every move may have a huge impact on the entire market. And before the analog chip hot, in addition to let Texas Instruments make a pot full of pot, the following small and medium-sized enterprises also tasted the sweet, have begun to expand production, mergers and acquisitions, market share is also more and more.

"Analog chip manufacturers generally adopt IDM mode, through continuous horizontal mergers and acquisitions, to expand their overall scale, and then consolidate their position. So the competition between the big players is more about the stock market, so expanding during the market downturn is also a strategy to take market share from competitors." Chuangdao Investment consulting general manager Bu Rixin told China Electronic News reporters said.

Take Texas Instruments. Despite the news that analog chip prices will fall, Texas Instruments announced on May 19 that it broke ground on a new 12-inch semiconductor wafer manufacturing facility in Sherman, Texas, a $30 billion project to build four plants to meet long-term market demand. These new facilities will produce tens of millions of analog and embedded processing chips a day for a wide range of electronic products in the global market. "This is part of TI's long-term capacity plan to continue to enhance TI's manufacturing capabilities and technology competitive advantage," said Michael Templeton, chairman, President and CHIEF Executive Officer of TI.

Liu Tun, deputy general manager of The Internet of Things Industry Research Center of CCID Consulting, believes that for leading enterprises, due to their strong capital and stronger risk resistance ability, they can maintain certain market competitiveness in the market fluctuations, and even while other small and medium-sized enterprises "stay put", further expand the market. As a result, TI was able to cut prices and expand production at the same time.

It is understood that Texas Instruments analog chip product models accumulated to reach tens of thousands, even if the general model also has tens of thousands. So while the price of some analog chips has fallen sharply, there are still plenty of chips to keep TI's revenue from swinging too much.

But this makes other small and medium enterprises become very passive. The high inventory of customers, as well as the high capacity and low prices of the head companies, may increase the competitive pressure on small businesses. For the head enterprises, it may be an opportunity to expand the market.

Smes should be prepared for market volatility

The analog chip market in the Internet of Things (IOT) may become an opportunity for small and medium-sized companies, although the hot track in the analog chip field, such as mobile phones and cars, is almost dominated by giants.

It is understood that the number of global Internet of Things connections will increase from 12 billion in 2019 to 24.6 billion in 2025, indicating a promising market. Among them, analog chip is an indispensable part of realizing "electronic +" in the Internet of Things technology. With the rise of the Internet of Things and the popularization of "electronic +" application, the demand for analog chip will greatly increase.

Liu Tun said that due to the rich application of the Internet of Things, there are many application scenarios of analog chips in the Internet of Things, and it is difficult for giant enterprises to cover all the scenarios. At the same time, due to the variety of application scenarios, there are few analog chips of general class in Internet of Things applications, and customized analog chips are generally adopted. Therefore, small and medium-sized enterprises can develop their own unique application products and build their own business barriers through chip customization in their own application scenarios.

Bu Rixin believes that in recent years, the chip industry has been greatly influenced by the outside world. The chip industry has changed its previous cyclical and stable development state, and the whole industry is in a stage of great fluctuation. In such a state, chip companies should be prepared to deal with volatility, to avoid cash flow problems caused by short-term sharp fluctuations. The same is true for analog chip racetracks.